WELCOME TO CITN

The Chartered Institute of Taxation of Nigeria started on February 4, 1982 as Association of Tax Administrators and Practitioners. Thereafter, it transformed into Nigeria Institute of Taxation, which was formally launched on February 21, 1982 and statutorily recognized on May 6, 1987 as company Limited by Guarantee.

The Institute was chartered by the Federal Government of Nigeria by the enabling Act No. 76 of 1992 (now CITN Act, CAP C10, Vol. 2, Laws of the Federation of Nigeria, 2004) and was charged with the responsibility, among others, of determining what standards of knowledge and skills are to be attained by persons seeking to become professional Tax Practitioners or Administrators.

Mr. Innocent Chinyere OHAGWA, FCTI

17th President/Chairman of Council

Mrs. Afolake OSO, FCTI

Registrar/CE

Tax Nuggets

CITN Weekly Tax Nuggets

Tax Nuggets

Vision

To be one of the foremost professional associations in Africa and beyond

Mission

To build an Institute which will be a citadel for the advancement of taxation in all its ramifications

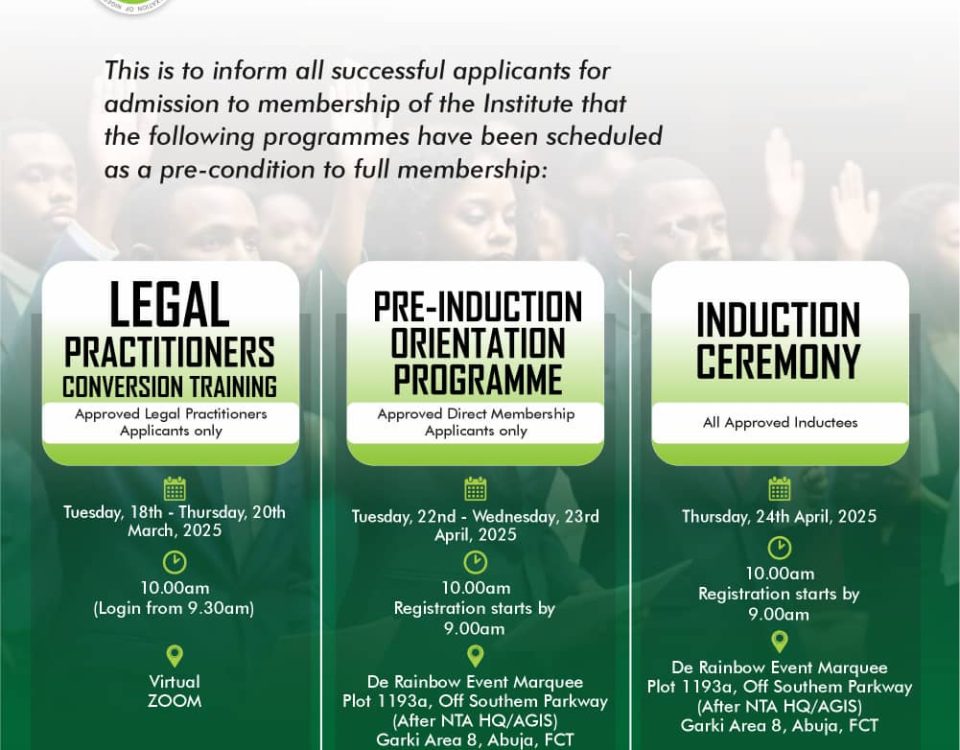

CREDENTIALING

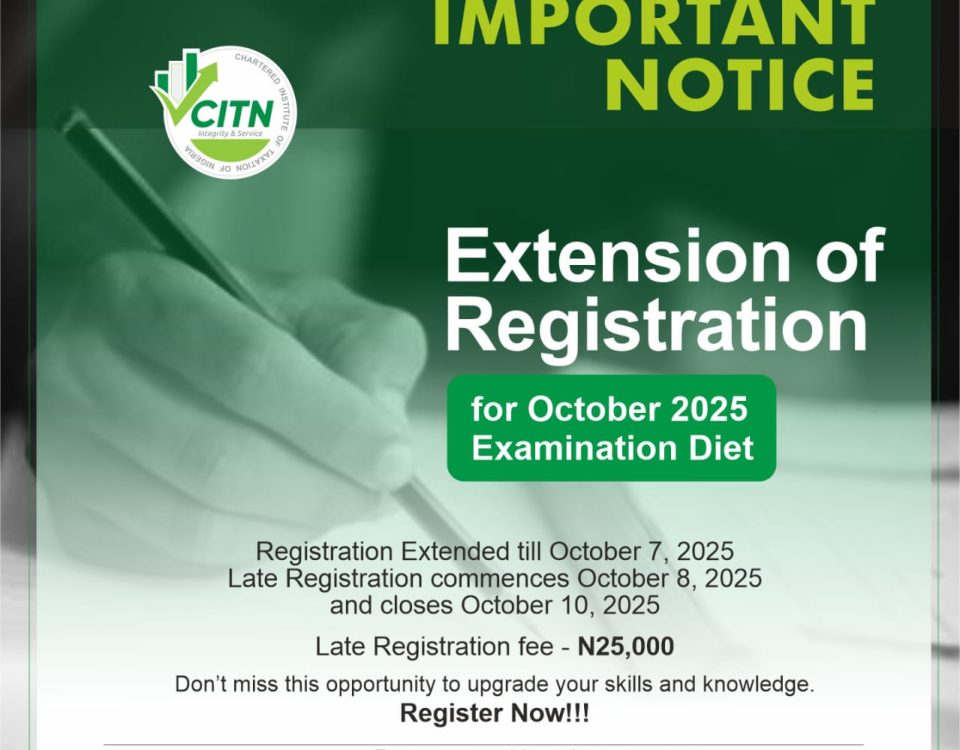

LATEST NEWS

WHAT WE DO

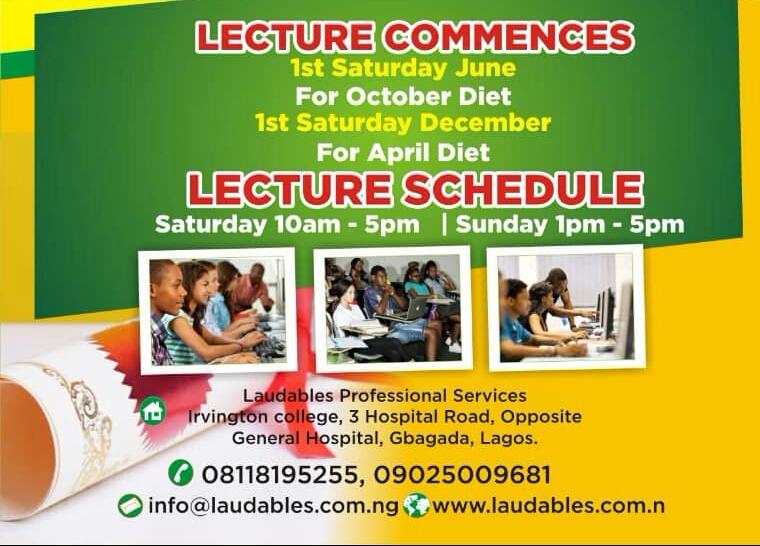

EDUCATION

TAX CONFERENCE

TRAINING

TAX ACADEMY

CERTIFICATION

We are proud to deliver

since 1982 and chartered since 1992

Advertisement

Knowledge and skills

To determine what standards of knowledge and skills are to be attained by persons seeking to become registered members of the taxation profession.

Standard of Taxation

To raise, maintain and regulate the standard of taxation practice amongst its members

Professional Ethics

To promote professional ethics and efficiency in tax administration and practice.